Equity Portfolio Construction

May 25, 2023Probably since before you made your first dollar, you were told about the importance of investing in the stock market – about the wonders of compounding returns over time that can transform a lifetime of savings into a car, a house, and a comfortable retirement.

The amount of money that these goals require certainly seems unattainable for the average person to accumulate by putting their savings under their mattress. Chances are that if you stumbled across this article, this is not news to you. So you know the “why” of investing, next comes the “what.” A quick Google search about stocks will reveal that there is no shortage of people, businesses, articles, and TV personalities that are ready to tell you about their hot stock tip. But of course, you have heard about diversification, too; likely accompanied by an idiom about a basket of eggs, so you know not to invest a significant amount of your money in one place. How many stocks do you need then?

Diversify Your Equity Portfolio

To say that equity portfolio construction can be daunting for the amateur investor is a bit of an understatement. While stocks are not the only asset class that can make up a portfolio, most portfolios with the goal of growing over time will have some portion invested in the stock market. Historically, stocks have been an excellent tool for investors with long-time horizons to grow their wealth. An investing axiom to keep in mind: as you take more risk, the level of expected return rises. The principle of diversification can help mitigate stock and sector specific risk. At its core, diversification is the principle that combining multiple stocks that move less than perfectly with one another will create a portfolio that is less risky than each of them individually. The lower the correlation two stocks have with one another, the greater the diversification benefit. To find a collection of stocks that share a low correlation with one another, we view diversification through several lenses.

What are Economic Sectors?

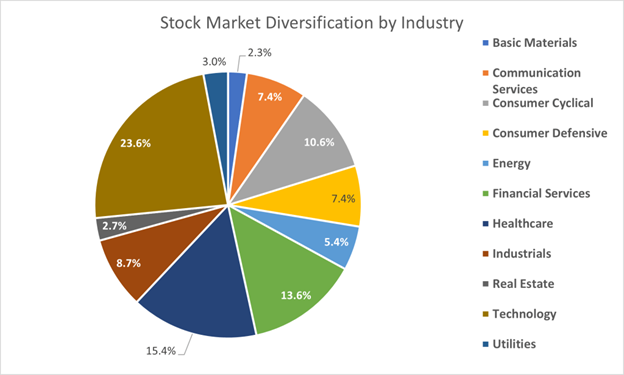

The first method of diversification when it comes to equity portfolio construction is to invest in companies across different economic sectors. The U.S. market is divided into 11 Morningstar sectors, such as financials, energy, healthcare, and technology. Within each sector there will be stocks that do well and stocks that do poorly, but the prices of companies within a given sector typically move together closely over time. There is sound logic why this is the case; fundamentally, stocks reflect ownership of a company, and therefore the price of a company’s stock follows expectations of future cash flows. A new industry trend or development – for example in healthcare or technology – will affect that sector’s stocks much more than it affects stocks in another sector. There are diversification benefits to be had by investing across all sectors. Our philosophy is to provide optimal diversification for your portfolio, which means market-like exposure across all sectors.

Source DFA, Inc.

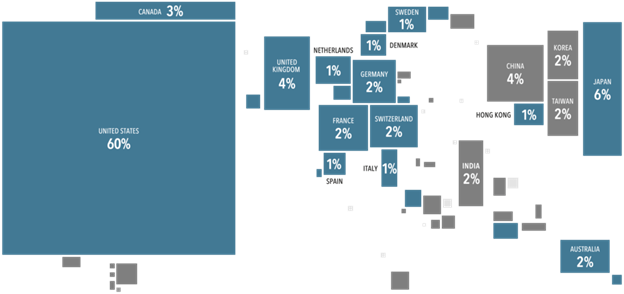

Invest in Companies in Different Countries

Another way we think about diversifying our exposures during equity portfolio construction is by investing in companies from all over the world. Many large corporations often derive revenue from many different countries. Apple, for instance, derives more than 60% of its sales (revenue) from outside of the U.S. Some argue that the geographical diversification gained from investing in large multinational firms based in the U.S. provides all the diversification benefits of adding foreign stock into a portfolio. The U.S has led the stock market with its far higher proportion of tech companies in the world. Other regions and countries bring to the table expertise in other industries and areas. By investing in these, too, you stand to benefit from global sources of innovation and success. It is apparent it is impossible to predict which countries or regions perform best over any timeframe. Owning them all reduces your portfolio’s risk as they perform differently in different periods.

Another way you can benefit by owning global companies is changes in currency value. If their currencies increase in value relative to the U.S dollar, that translates into more U.S. dollars for U.S. shareholders.

Invest in Companies of Different Sizes

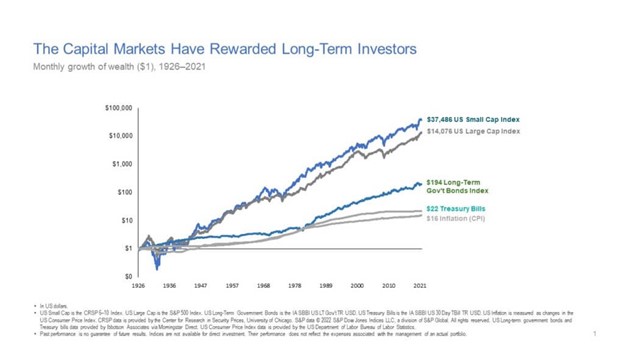

The last dimension we think of in our diversification strategy is company size, or market capitalization (market cap). Market cap is simply the combined value of a company’s shares. The stock market is broken down into large-cap, mid-cap, and small-cap companies. Unfortunately, there are no hard and fast rules about what the size cutoffs are for each category; but without splitting hairs over definitions, it is important to note that about 80% of the whole stock market is made up of “large” companies. Furthermore, the typical indexes that usually serve as a proxy for the stock market’s performance such as the S&P 500, and the Dow Jones Industrial Average are made up of 100% large companies. Because small and large companies have different characteristics, an allocation to small-cap stocks can cause portfolio returns to significantly diverge from the returns of the traditional market benchmarks, for better and for worse. Throughout history, small companies on average have offered a higher return than their large cap, blue chip counterparts, but with more risk. The reason behind this is intuitive: small companies have more opportunities for growth, but don’t have the financial stability of large companies during challenging economic conditions, which creates a wider range of potential outcomes. Due to the less than perfect correlation with large-cap stocks, however, a small allocation to small-cap stocks serves to reduce the overall riskiness of a portfolio while also providing a higher potential for return. We maintain a small and broad-reaching exposure to small-cap stocks to capture that diversification benefit.

By remaining invested across all sectors, countries of origin, and different size companies, we expect to reduce risk and improve risk-adjusted returns for you as our client.

Contact an Experienced Wealth Management Advisor Near You

Of course, we aim to provide the best service possible and will make every effort to get your cash to you when you need it. That being said, these are investment accounts and not bank accounts, so a little planning goes a long way to making the process as smooth and painless as possible.

We are proudly a fee-only, independently-owned financial planning firm that acts as a fiduciary for our clients. We have built our organization to put our customers’ interests first, as evidenced by our fee-only fee structure and fiduciary responsibility.

If you’re interested in our services, please contact us. If you would like to learn more about financial planning, wealth management, and finding a financial advisor, please visit other areas of our education section.

Contact us

"*" indicates required fields

Stock Market Diversification by Industry chart:

Graph for illustrative purposes only. Weights are derived from Vanguard S&P 500 ETF which tracks S&P 500. Morningstar, 11/30/22

The Capital Markets Have Rewarded Long-Term Investors chart:

In US dollars. US Small Cap is the CRSP 6–10 Index. US Large Cap is the S&P 500 Index. US Long-Term Government Bonds is the IA SBBI US LT Gov’t TR USD. US Treasury Bills is the IA SBBI US 30 Day TBill TR USD. US Inflation is measured as changes in the US Consumer Price Index. CRSP data is provided by the Center for Research in Security Prices, University of Chicago. S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. US Long-term government bonds and Treasury bills data provided by Ibbotson Associates via Morningstar Direct. US Consumer Price Index data is provided by the US Department of Labor Bureau of Labor Statistics. Past performance is no guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

Modera Wealth Management, LLC (“Modera”) is an SEC registered investment adviser. SEC registration does not imply any level of skill or training. Modera may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. For information pertaining to Modera’s registration status, its fees and services please contact Modera or refer to the Investment Adviser Public Disclosure Web site (www.adviserinfo.sec.gov) for a copy of our Disclosure Brochure which appears as Part 2A of Form ADV. Please read the Disclosure Brochure carefully before you invest or send money.

This article is limited to the dissemination of general information about Modera’s investment advisory and financial planning services that is not suitable for everyone. Nothing herein should be interpreted or construed as investment advice nor as legal, tax or accounting advice nor as personalized financial planning, tax planning or wealth management advice. For legal, tax and accounting-related matters, we recommend you seek the advice of a qualified attorney or accountant. This article is not a substitute for personalized investment or financial planning from Modera. There is no guarantee that the views and opinions expressed herein will come to pass, and the information herein should not be considered a solicitation to engage in a particular investment or financial planning strategy. The statements and opinions expressed in this article are subject to change without notice based on changes in the law and other conditions.

Investing in the markets involves gains and losses and may not be suitable for all investors. Information herein is subject to change without notice and should not be considered a solicitation to buy or sell any security or to engage in a particular investment or financial planning strategy. Individual client asset allocations and investment strategies differ based on varying degrees of diversification and other factors. Diversification does not guarantee a profit or guarantee against a loss.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.